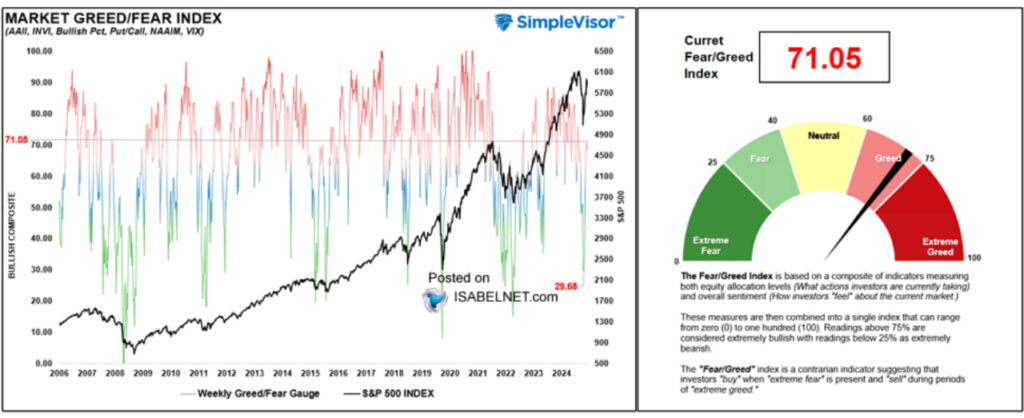

The Fear & Greed Index currently sits at 71.05 — indicating a greedy market, but not yet in overheated territory.

This suggests that bulls may still have room to push the market higher.

Historically, final bullish impulses often occur at these levels.

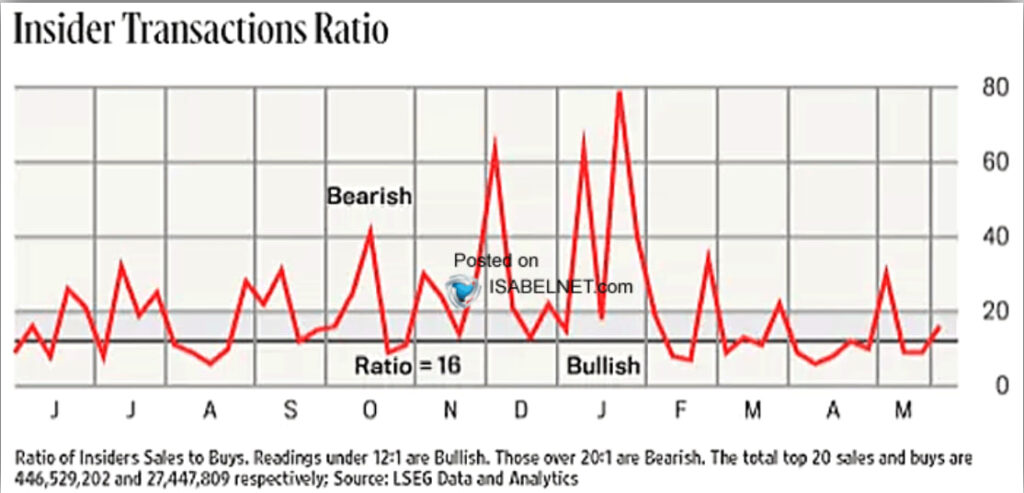

What about insiders?

The sell-to-buy ratio is just 16:1 — far from panic territory.

After heavy selling in the fall and winter, insider activity has gone quiet, potentially signaling that they’re also expecting higher levels.

Conclusion:

The market is locally overheated, but not exhausted.

Bulls remain active — just don’t forget stop-losses, proper risk management, and always do your own research (DYOR).